April 26, 2019

Dear Stockholder:

You are invited to attend the annual meeting of stockholders (the “Annual Meeting”) of Codexis, Inc. (“Codexis,” “we,” “us” or “our”) to be held on Monday, June 11, 2019, at 9:00 a.m., California time, at our executive offices at 400 Penobscot Drive, Redwood City, California.

At this year’s Annual Meeting, you will be asked to:

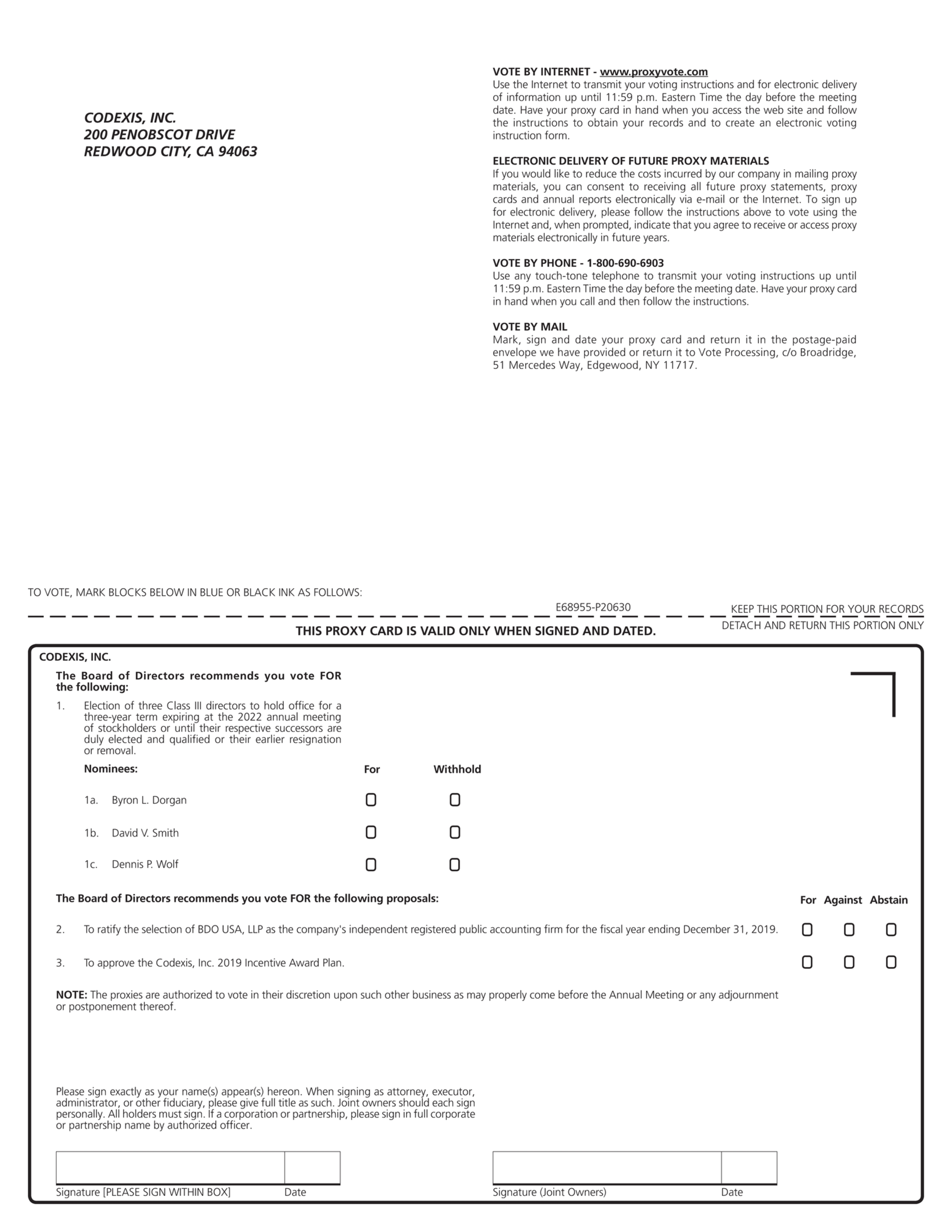

| (i) | elect three Class III directors to hold office until the 2022 annual meeting of stockholders; |

| (ii) | ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| (iii) | approve the Codexis, Inc. 2019 Incentive Award Plan; and |

| (iv) | transact such other business as may properly come before the Annual Meeting. |

The accompanying Notice of Annual Meeting and proxy statement describe these matters. We urge you to read this information carefully.

Your board of directors unanimously believes that election of its nominees for director, the ratification of the Audit Committee’s selection of our independent registered public accounting firm and the approval of the Codexis, Inc. 2019 Incentive Award Plan are in the best interest of Codexis and its stockholders, and, accordingly, recommends a vote “FOR” election of its nominees for director, “FOR” the ratification of the selection of BDO USA, LLP as our independent registered public accounting firm, and “FOR” the approval of the Codexis, Inc. 2019 Incentive Award Plan.

In addition to the business to be transacted as described above, management will speak on our developments of the past year and respond to comments and questions of general interest to stockholders.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please vote as soon as possible. You may vote on the Internet or by telephone. If, however, you requested to receive paper proxy materials, then you may also vote by mailing a complete, signed and dated proxy card or voting instruction card in the envelope provided. Voting by written proxy, over the Internet or by telephone will ensure your shares are represented at the Annual Meeting.

|

|

Sincerely,

|

|

|

|

|

|

John J. Nicols

|

|

|

President and Chief Executive Officer

|