UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | | | | |

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to § 240.14a-12 |

CODEXIS, INC. |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý | | No fee required. |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1 | ) | | Title of each class of securities to which transaction applies: |

| | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | (5 | ) | | Total fee paid: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1 | ) | | Amount Previously Paid: |

| | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | (3 | ) | | Filing Party: |

| | (4 | ) | | Date Filed: |

April 30, 2013

Dear Stockholder:

You are invited to attend the annual meeting of stockholders (the “Annual Meeting”) of Codexis, Inc. (“Codexis,” “we,” “us” or “our”) to be held on Wednesday, June 12, 2013, at 9:00 a.m., California time, at our executive offices at 400 Penobscot Drive, Redwood City, California.

At this year’s Annual Meeting, you will be asked to:

| |

(i) | elect three Class III directors to hold office until the 2016 annual meeting of stockholders; |

| |

(ii) | ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and |

| |

(iii) | transact such other business as may properly come before the Annual Meeting. |

The accompanying Notice of Annual Meeting and proxy statement describe these matters. We urge you to read this information carefully.

Your board of directors unanimously believes that election of its nominees for director and ratification of the Audit Committee’s selection of our independent registered public accounting firm are in the best interests of Codexis and its stockholders, and, accordingly, recommends a vote “FOR” election of its nominee for director and “FOR” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm.

In addition to the business to be transacted as described above, management will speak on our developments of the past year and respond to comments and questions of general interest to stockholders.

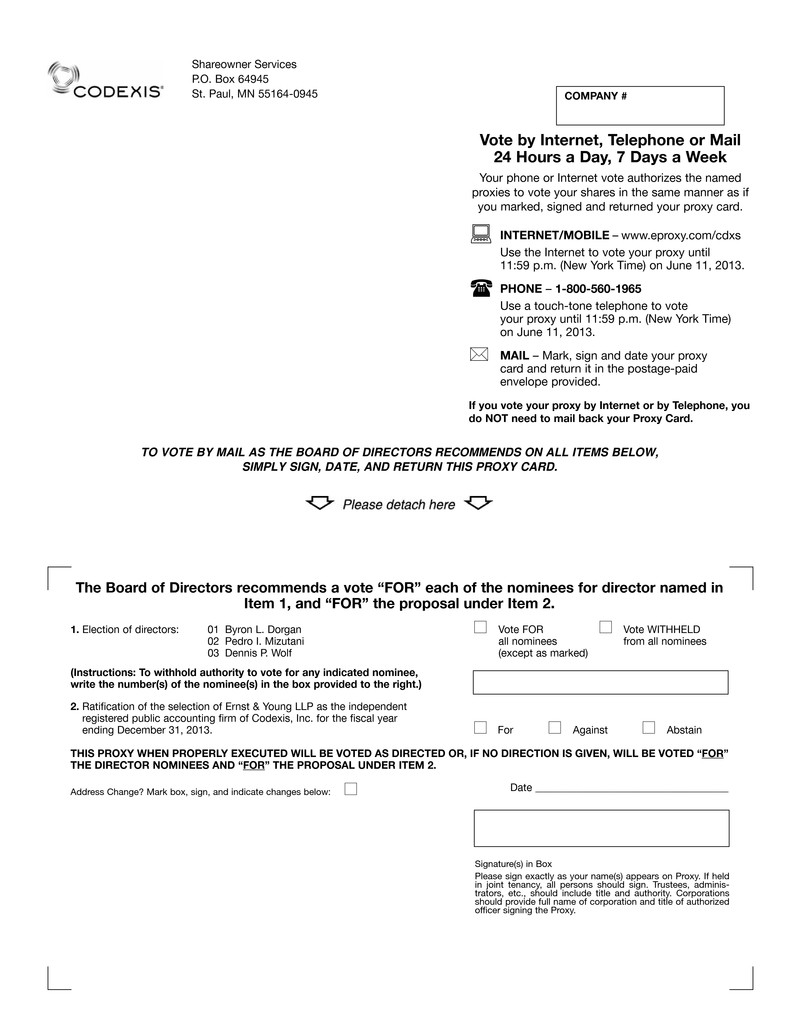

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please complete, sign, date and return the enclosed proxy card as promptly as possible in order to ensure your representation at the Annual Meeting. You may also vote on the Internet or by telephone, and the instructions for doing so are set forth in the enclosed proxy card. Voting by written proxy, over the Internet or by telephone will ensure your shares are represented at the Annual Meeting.

|

|

Sincerely, |

|

Douglas T. Sheehy |

Senior Vice President, General Counsel and Secretary |

CODEXIS, INC.

200 Penobscot Drive

Redwood City, CA 94063

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, JUNE 12, 2013

To the Stockholders of Codexis, Inc. (“Codexis,” “we, “us” and “our”):

We will hold an annual meeting of our stockholders (the “Annual Meeting”) at our executive offices at 400 Penobscot Drive, Redwood City, California, on Wednesday, June 12, 2013, 9:00 a.m., California time, for the following purposes:

1. To elect each of Byron L. Dorgan, Pedro I. Mizutani and Dennis P. Wolf to our board of directors for a three-year term expiring at the 2016 annual meeting of stockholders or until their respective successors are duly elected and qualified or their earlier resignation or removal.

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013.

3. To transact any other business as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

These items of business are described in the attached proxy statement. Only stockholders of record of shares of our common stock at 5:00 p.m., New York time, on April 22, 2013, the record date for the Annual Meeting, are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting.

A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting, and at the principal executive offices of Codexis during regular business hours for a period of no less than ten days prior to the Annual Meeting.

Your vote is very important. It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. You may vote by completing and mailing the proxy card enclosed with the proxy statement, or you may grant your proxy electronically via the Internet or by telephone by following the instructions on the proxy card. If your shares are held in “street name,” which means your shares are held of record by a broker, bank or other nominee, you should review the instructions provided to you by that broker, bank or other nominee to determine how you will be able to submit your voting instructions. Submitting a proxy over the Internet, by telephone or by mailing a proxy card, will ensure that your shares are represented at the Annual Meeting.

|

|

Sincerely, |

|

Douglas T. Sheehy |

Senior Vice President, General Counsel and Secretary |

The enclosed proxy statement is dated April 30, 2013 and is first being mailed to stockholders on or about May 7, 2013.

TABLE OF CONTENTS

|

| |

| Page |

INFORMATION CONCERNING VOTING AND SOLICITATION | |

General | |

Important Notice Regarding the Availability of Proxy Materials | |

Who Can Vote | |

Voting of Shares | |

Revocation of Proxy | |

Voting in Person | |

Quorum and Votes Required | |

Solicitation of Proxies | |

Security Ownership of Certain Beneficial Owners and Management | |

Annual Report | |

Assistance | |

Forward-Looking Statements | |

| |

ITEM 1 ELECTION OF DIRECTORS | |

Board Structure | |

Director Nominee | |

Director Biographical Information | |

Board Recommendation on Item 1 | |

Directors Not Standing for Election | |

Director Biographical Information | |

Executive Officers | |

Executive Officer Biographical Information | |

| |

CORPORATE GOVERNANCE MATTERS | |

Composition of the Board of Directors | |

Board Leadership Structure | |

Board Meetings | |

Board Committees | |

Risk Oversight | |

Director Nominations and Board Diversity | |

Compensation Committee Interlocks and Insider Participation | |

Communication with the Board | |

Code of Business Conduct and Ethics | |

Director Compensation | |

Director Compensation Table | |

| |

ITEM 2 RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

Principal Accounting Fees and Services | |

Board Recommendation on Item 2 | |

| |

EXECUTIVE COMPENSATION | |

Compensation Discussion and Analysis | |

2012 Summary Compensation Table | |

Grants of Plan-Based Awards in 2012 Table | |

Outstanding Equity Awards at 2012 Fiscal Year-End Table | |

Option Exercises and Stock Vested in 2012 | |

|

| |

| Page |

Pension Benefits | |

Nonqualified Deferred Compensation | |

Change in Control Agreements | |

Equity Compensation Plan Information | |

Compensation Committee Report | |

| |

AUDIT MATTERS | |

Audit Committee Report | |

| |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

Policies and Procedures for Related Party Transactions | |

| |

OTHER MATTERS | |

Section 16(a) Beneficial Ownership Reporting Compliance | |

Stockholder Proposals and Nominations | |

Householding of Proxy Materials | |

Incorporation by Reference | |

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

General

Your proxy is solicited on behalf of the board of directors of Codexis, Inc., a Delaware corporation (“Codexis,” “we,” “us” or “our”), for use at our 2013 annual meeting of stockholders (the “Annual Meeting”) to be held on Wednesday, June 12, 2013, at 9:00 a.m., California time, at our executive offices at 400 Penobscot Drive, Redwood City, California, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting and any business properly brought before the Annual Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting.

This proxy statement and accompanying proxy card are first being mailed to stockholders entitled to vote at the Annual Meeting on or about May 7, 2013.

Important Notice Regarding the Availability of Proxy Materials for the 2013 Annual Meeting of Stockholders to Be Held on June 12, 2013

This proxy statement, our Annual Report on Form 10-K for the year ended December 31, 2012 and the form of proxy card are available on our website at http://www.codexis.com/proxy.

Who Can Vote

You are entitled to vote if you are a stockholder of record of our common stock (or “common stock”) as of the close of business on April 22, 2013. You are entitled to one vote for each share of common stock held on all matters to be voted upon at the Annual Meeting. Your shares may be voted at the Annual Meeting only if you are present in person or represented by a valid proxy.

Voting of Shares

If, at the close of business on April 22, 2013, your shares of common stock were registered directly in your name with Wells Fargo Bank, National Association, our transfer agent, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the preaddressed, postage paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card. If your shares of common stock are held in street name through a broker, bank, or other nominee, you are considered the beneficial owner of those shares and you have the right to instruct your broker, bank or other nominee, who is considered the stockholder of record for the purposes of voting at the Annual Meeting, on how to vote the shares in your account. Your broker, bank or nominee will send you a voting instruction form for you to use to direct how your shares should be voted.

The Internet and telephone voting will close at 11:59 p.m., New York time, on June 11, 2013. If you vote through the Internet, you should be aware that you may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by you. If you vote by the Internet or telephone, then you need not return a written proxy card by mail.

YOUR VOTE IS VERY IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting. If you properly give your proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed.

All shares entitled to vote and represented by properly submitted proxies (including those submitted electronically, telephonically and in writing by 11:59 p.m., New York time, on June 11, 2013) that are received before the polls are closed at the Annual Meeting, and that are not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no direction is indicated on a proxy, your shares will be voted “FOR” the election of Byron L. Dorgan, Pedro I. Mizutani and Dennis P. Wolf as our Class III directors and “FOR” the ratification of the selection of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm. The proxy gives each of John J. Nicols, David D. O'Toole and Douglas T. Sheehy discretionary authority to vote your shares in accordance with his best judgment with respect to all additional matters that might come before the Annual Meeting.

Revocation of Proxy

If you are a stockholder of record, you may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions:

| |

• | delivering to our Secretary a signed written notice of revocation, bearing a date later than the date of the original proxy, stating that the original proxy is revoked; |

| |

• | signing and delivering a new paper proxy, relating to the same shares and bearing a later date than the original proxy; |

| |

• | submitting another proxy by telephone or over the Internet (your latest telephone or Internet voting instructions are followed); or |

| |

• | attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will not, by itself, revoke a proxy. |

Written notices of revocation and other communications with respect to the revocation of Codexis proxies should be addressed to:

Codexis, Inc.

200 Penobscot Drive

Redwood City, CA 94063

Attn: Secretary

If your shares are held in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so. See below regarding how to vote in person if your shares are held in street name.

Voting in Person

If you plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note, however, that if your shares are held in “street name,” which means your shares are held of record by a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the broker, bank or other nominee who is the record holder of the shares, authorizing you to vote at the Annual Meeting.

Quorum and Votes Required

At 5:00 p.m., New York time, on April 22, 2013, 38,026,352 shares of our common stock were outstanding and entitled to vote. All votes will be tabulated by the inspector of elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes and abstentions.

Quorum. A majority of the outstanding shares of common stock, present in person or represented by proxy at the Annual Meeting, will constitute a quorum at the Annual Meeting. Shares of common stock held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions as to a particular proposal and broker “non-votes” will be counted as present for purposes of determining a quorum.

Broker Non-Votes. Brokers or other nominees who hold shares of common stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or for any matter that the United States Securities Exchange Commission (“SEC”) determines to be a “significant matter” without specific instructions from the beneficial owner. These non-voted shares are referred to as “broker non-votes.” If your broker holds your common stock in “street name,” your broker is not entitled to vote your shares on “non-routine” proposals (i.e., of the proposals to be considered at the Annual Meeting, the Election of Directors) without your instruction and will only vote your shares on such proposals if you provide instructions on how to vote by filling out the voter instruction form sent to you by your broker with this proxy statement.

Election of Class III Director. Our bylaws provide that a plurality of votes cast in favor of the election of a director shall be sufficient to elect such director to the board of directors. Under this plurality voting standard, the nominees for available directorships who receive the highest number of affirmative votes cast are elected. In the event that three candidates are up for election for three board of director seats, for example, a plurality of the votes cast means that the three candidates receiving the highest number of affirmative votes cast “FOR” will each be elected as directors. Withheld votes will not have any effect on the election of directors. Brokers are not empowered to vote on the election of directors without instruction from the beneficial owner of the shares and thus broker non-votes likely will occur. Since broker non-votes are not considered votes cast for a candidate, they will not have any effect on the election of directors.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares represented in person or by proxy at the Annual Meeting and entitled to vote is required for the ratification of the selection of Ernst & Young as our independent registered public accounting firm. Withheld votes will have the same effect as voting against

this proposal. Brokers generally have discretionary authority to vote on the ratification of our independent registered public accounting firm, thus broker non-votes are generally not expected to result from the vote on this proposal.

Solicitation of Proxies

Our board of directors is soliciting proxies for the Annual Meeting from our stockholders. We will bear the entire cost of soliciting proxies from our stockholders. In addition to the solicitation of proxies by mail, we will request that brokers, banks and other nominees that hold shares of our common stock, which are beneficially owned by our stockholders, send Notices of Annual Meeting, proxies and proxy materials to those beneficial owners and secure those beneficial owners’ voting instructions. We will reimburse those record holders for their reasonable expenses.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of shares of our common stock as of April 22, 2013 for:

| |

• | each person known to us to be the beneficial owner of more than 5% of our outstanding shares of common stock; |

| |

• | each of our named executive officers; |

| |

• | each of our directors; and |

| |

• | all directors and current executive officers as a group. |

Unless otherwise noted below, the address of each beneficial owner listed on the table is c/o Codexis, Inc., 200 Penobscot Drive, Redwood City, CA 94063. We have determined beneficial ownership in accordance with the rules promulgated by the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the tables below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock subject to options or warrants held by that person that are currently exercisable or exercisable within 60 days of April 22, 2013. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

Percentage of beneficial ownership is based on 38,026,352 shares of common stock outstanding as of April 22, 2013.

|

| | | | |

Name and Address of Beneficial Owner | | Number of Shares Beneficially Owned | | Percentage of Shares Beneficially Owned |

5% Stockholders: | | | | |

Raízen Energia S.A.(1) | | 5,573,319 | | 14.65% |

Biomedical Sciences Investment Fund Pte Ltd(2) | | 3,158,522 | | 8.31% |

Entities and persons affiliated with CMEA Ventures(3) | | 3,013,133 | | 7.90% |

Executive Officers and Directors | | | | |

John J. Nicols(4) | | 931,000 | | 2.44% |

David D. O'Toole | | 70,000 | | * |

David L. Anton(5) | | 299,087 | | * |

Douglas T. Sheehy(6) | | 331,102 | | * |

Matt Tobin(7) | | 113,467 | | * |

Brian P. Dowd(8) | | 30,599 | | * |

Robert J. Lawson(9) | | 6,291 | | * |

Alan Shaw(10) | | 291,666 | | * |

Peter M. Strumph(11) | | 17,384 | | * |

Mark Ho(12) | | 553 | | * |

Thomas R. Baruch(13) | | 3,053,133 | | 8.00% |

Byron L. Dorgan(14) | | 95,000 | | * |

Alexander A. Karsner(15) | | 123,332 | | * |

Bernard J. Kelley(16) | | 153,328 | | * |

Pedro I. Mizutani | | — | | — |

Dennis P. Wolf(17) | | 106,664 | | * |

All current executive officers and directors as a group (12 persons)(18) | | 5,181,385 | | 13.60% |

____________________

* Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

| |

(1) | The shares are held by Raízen Energia S.A. (“Raízen”), a joint venture formed between Shell Brazil Holdings B.V. (“Shell Brazil”) and Cosan S.A. Industria e Comércio (“Cosan S.A.”). Shell Brazil is a publicly held company controlled by RDS and Cosan S.A. is a direct subsidiary of Cosan Limited (“Cosan” and together with Cosan S.A., the “Cosan Group”). Shell Brazil and the Cosan Group have shared power to vote and to dispose of the shares and may each thereby be deemed to be a beneficial owner thereof. The address of Raízen is Avenida Presidente Juscelino Kubitschek, 1327 5º andar, Sao Paulo, SP, CEP 04543-011, Brazil. The address for Shell Brazil is Carel Van Bylandtlaan 30, 2596 HR The Hague, The Netherlands. The address for Cosan S.A. is Avenida Presidente Juscelino Kubitschek, 1327, 4º andar, Sao Paulo, SP CEP 04543-011, Brazil. The address for Cosan is Avenida Presidente Juscelino Kubitschek, 1327, 4º andar, Sao Paulo, SP CEP 04543-011, Brazil. |

| |

(2) | Based solely on a Schedule 13G filed by Biomedical Sciences Investment Fund Pte Ltd (“BMSIF”) on January 22, 2013. EDB Investments Pte Ltd (“EDB Investments”) is the parent entity of BMSIF. The Economic Development Board of Singapore (“EDB”) is the parent entity of EDB Investments. EDB is a Singapore government entity. EDB Investments, EDB and the Singapore government may be deemed to have shared voting and dispositive power over the shares owned beneficially and of record by BMSIF. The address of BMSIF is 250 North Bridge Road #20-02, Raffles City Tower, Singapore 179101. |

| |

(3) | Includes (i) 2,740,158 outstanding shares and 86,178 shares that may be acquired pursuant to the exercise of a warrant held by CMEA Ventures Life Sciences 2000, L.P. and (ii) 181,067 outstanding shares and 5,730 shares that may be acquired pursuant to the exercise of a warrant held by CMEA Ventures Life Sciences 2000, Civil Law Partnership. CMEA Ventures LS Management 2000, L.P. is the general partner of CMEA Ventures Life Sciences 2000, L.P. and the managing limited partner of CMEA Ventures Life Sciences 2000, Civil Law Partnership. David Collier, Karl Handelsman and Thomas R. Baruch are the general partners of CMEA Ventures LS Management 2000, L.P. and as such, have voting and dispositive power over these shares. Each disclaims beneficial ownership of the shares and warrants held by these entities except to the extent of any pecuniary interest therein. The address of each of the reporting persons is 1 Letterman Drive, Building C, Suite CM500, San Francisco, CA 94129. |

| |

(4) | Includes 100,000 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. |

| |

(5) | Includes 278,986 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. |

| |

(6) | Includes 311,001 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. |

| |

(7) | Includes 86,127 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. |

| |

(8) | Based solely on a Form 4 filed by Mr. Dowd on June 5, 2012 and subsequent equity award vesting, exercise and termination information known to Codexis. Mr. Dowd's employment with Codexis terminated on June 28, 2012. |

| |

(9) | Based solely on a Form 4 filed by Mr. Lawson on May 12, 2011 and subsequent equity award vesting, exercise and termination information known to Codexis. Mr. Lawson resigned from Codexis on March 7, 2012. |

| |

(10) | Based solely on a Form 4 filed by Dr. Shaw on December 19, 2011 and subsequent equity award vesting, exercise and termination information known to Codexis. Includes 202,000 shares held by The Shaw Living Trust UAD 6/11/2008, Alan Shaw and Christine Shaw Trustees. Dr. Shaw resigned from Codexis on February 17, 2012. |

| |

(11) | Based solely on a Form 4 filed by Mr. Strumph on June 5, 2012 and subsequent equity award vesting, exercise and termination information known to Codexis. Mr. Strumph resigned from Codexis on July 31, 2012. |

| |

(12) | Based solely on a Form 3 filed by Mr. Ho on July 17, 2012 and subsequent equity award vesting, exercise and termination information known to Codexis. Mr. Ho resigned from Codexis on October 12, 2012. |

| |

(13) | Includes (i) 2,740,158 outstanding shares and 86,178 shares that may be acquired pursuant to the exercise of a warrant held by CMEA Ventures Life Sciences 2000, L.P., (ii) 181,067 outstanding shares and 5,730 shares that may be acquired pursuant to the exercise of a warrant held by CMEA Ventures Life Sciences 2000, Civil Law Partnership and (iii) 40,000 shares issuable to Mr. Baruch pursuant to stock options exercisable within 60 days of April 22, 2013. CMEA Ventures LS Management 2000, L.P. is the general partner of CMEA Ventures Life Sciences 2000, L.P. and the managing limited partner of CMEA Ventures Life Sciences 2000, Civil Law Partnership. Mr. Baruch is a general partner of CMEA Ventures LS Management 2000, L.P. and as such, has voting and dispositive power over these shares. Mr. Baruch disclaims beneficial ownership of the shares and warrants held by these entities except to the extent of his pecuniary interest therein. |

| |

(14) | Includes 95,000 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. |

| |

(15) | Includes 123,332 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. Such options are vested as to 121,248 shares, which have an exercise price range from $3.62 to $10.92 per share, and the remaining 2,084 shares, if the options are exercised, would be subject to a right of repurchase within 60 days of April 22, 2013 at the original option exercise price of $9.09 per share in the event Mr. Karsner ceases to provide services to us. |

| |

(16) | Includes 128,330 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. Such options are vested as to 125,899 shares, and the remaining 2,431 shares, if the options are exercised, would be subject to a right of repurchase within 60 days of April 22, 2013, at the original option exercise price, in the event Mr. Kelley ceases to provide services to us. The option exercise prices range from $3.62 to $10.92 per share. |

| |

(17) | Includes 106,664 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013. Such options are vested as to 104,233 shares, and the remaining 2,431 shares, if the options are exercised, would be subject to a right of repurchase within 60 days of April 22, 2013, at the original option exercise price, in the event Mr. Wolf ceases to provide services to us. The option exercise prices range from $3.62 to $10.92 per share. |

| |

(18) | Includes 1,352,060 shares issuable pursuant to stock options exercisable within 60 days of April 22, 2013 |

Annual Report

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, which contains our consolidated financial statements for fiscal 2012, accompanies this proxy statement.

Assistance

If you need assistance completing your proxy card or in voting over the Internet or have questions regarding the Annual Meeting, please contact our transfer agent, Wells Fargo Shareowner Services, at 1110 Centre Pointe Curve, Suite 101, Mendota Heights, Minnesota 55120-4100, or by telephone at (800) 468-9716.

Forward-Looking Statements

This proxy statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2012, our quarterly reports on Form 10-Q and our current reports on Form 8-K.

ITEM 1

ELECTION OF DIRECTORS

Board Structure

Our bylaws provide for a fixed number of directors as set by the board of directors. The board has set the current number of authorized directors at seven. The directors are divided into three classes, each of whom serves for a term of three years: Class I directors (who hold office until the close of the 2014 annual meeting of stockholders), Class II directors (who hold office until the close of the 2015 annual meeting of stockholders) and Class III directors (who hold office until the close of the Annual Meeting). There are currently seven directors on our board. At each annual meeting of stockholders, the term of one of the classes of directors expires. The class of directors with a term expiring at the Annual Meeting, the Class III directors, currently consists of three directors.

Director Nominees

In 2011, our board of directors designated Byron L. Dorgan, Pedro I. Mizutani and Dennis P. Wolf as Class III directors. Based upon the recommendation of our nominating and corporate governance committee, our board of directors has nominated each of Byron L. Dorgan, Pedro I. Mizutani and Dennis P. Wolf as a Class III director to our board. If elected, each director nominee would serve a three-year term expiring at the close of our 2016 annual meeting of stockholders, or until his successor is duly elected and qualified. Each of Mr. Dorgan, Mr. Mizutani and Mr. Wolf currently serve on our board of directors, and each has agreed to be named in this proxy statement and to serve as a director if elected. Biographical information on each of the nominee directors is furnished below under “Director Nominee Biographical Information.”

Set forth below is information regarding the director nominees, as of April 22, 2013:

|

| | | | |

Name | | Age | | Director Since |

Byron L. Dorgan(1)(2)(3) | | 70 | | 2011 |

Pedro I. Mizutani | | 53 | | 2011 |

Dennis P. Wolf(1)(3) | | 60 | | 2007 |

| |

(1) | Member of the Audit Committee |

| |

(2) | Member of the Compensation Committee |

| |

(3) | Member of the Nominating and Corporate Governance Committee |

Director Nominee Biographical Information

The following director nominee biographical information is furnished with regard to the director nominees as of April 22, 2013.

Byron L. Dorgan has served as a director of Codexis since February 2011. Mr. Dorgan brings to our board of directors a wealth of experience in the energy sector, policy making and government affairs. Mr. Dorgan represented the State of North Dakota in the United States Senate from 1992 to January 2011. Prior to serving in the United States Senate, Mr. Dorgan served in the United States House of Representatives from 1981 to 1992. During his time in the United States Senate, Mr. Dorgan served in the United States Senate Leadership, first as Assistant Democratic Floor Leader and then as Chairman of the Democratic Policy Committee. He also served as the Chairman of the Committee on Indian Affairs and was the senior Senator on the Appropriations, Energy and Commerce Committees. Prior to being elected to the United States House of Representatives, Mr. Dorgan served as North Dakota State Tax Commissioner from 1969 until 1980. Mr. Dorgan is also the author of two books, Take this Job and Ship It: How Corporate Greed and Brain-Dead Politics Are Selling Out America, a New York Times bestseller, and Reckless! How Debt, Deregulation and Dark Money Nearly Bankrupted America. Mr. Dorgan holds a B.S. from the University of North Dakota and an M.B.A. from the University of Denver.

Pedro I. Mizutani has served as a director of Codexis since July 2011. He brings to our board of directors extensive executive experience in industrial, financial and agricultural operations, as well as in-depth knowledge of the Brazilian fuels and sugars markets. Since June 2011, Mr. Mizutani has served as Chief Operating Officer of Raízen S.A. and Raízen Energia S.A., where he is responsible for Raízen's upstream business (production of sugar, ethanol and bioenergy), as well as Executive Officer of Raízen Combustiveis S.A. (together with Raízen S.A. and Raízen Energia S.A., the “Raízen Entities”), where he is responsible for Raízen's downstream business (distribution, commercialization, retail and/or sale of fuel and fuel products). The Raízen Entities, which produce, market, distribute and export sugars and ethanol, are jointly controlled by Cosan S.A. Indústria e Comércio (“Cosan S.A.”), indirectly controlled by Cosan Limited, and Shell Brazil Holding B.V, indirectly controlled by RDS. Mr. Mizutani has also served as a director of Cosan S.A. since 2000 and as an officer from 2000 through June 2011. Cosan S.A. focuses on the production, transportation and distribution of renewable energy sources. Mr. Mizutani also previously served as CEO of Raízen Energia S.A. (formerly known as Cosan Sugar and Ethanol) from 2002 to June 2011, at which point it was contributed to the Raízen Entities as part of a joint venture with RDS. Mr. Mizutani holds a degree in production engineering from the University of São Paulo, an M.B.A. from the Getulio Vargas Foundation and a post-graduate degree in finance from the Methodist University of Piracicaba.

Dennis P. Wolf has served as a director of Codexis since December 2007. Mr. Wolf brings to our board of directors extensive experience in financial management, corporate finance and public company corporate governance. Mr. Wolf has served as Executive Vice President and Chief Financial Officer of Fusion-io Multisystems, a computer hardware and software systems company, since October 2010, which he joined as Chief Financial Officer in November 2009 and served as Senior Vice President from March 2010 to October 2010. From January 2009 to April 2009, Mr. Wolf served as interim Chief Executive Officer and Chief Financial Officer of Finjan Software, Inc., a provider of web security solutions. Previously, from March 2005 to June 2008, Mr. Wolf served as Executive Vice President and Chief Financial Officer of MySQL AB, an open source database software company. Prior to MySQL, Mr. Wolf held financial management positions for public high technology companies including Apple Inc., Centigram Communications, Inc., Credence Systems Corporation, Omnicell, Inc., Redback Networks Inc. and Sun Microsystems, Inc. Mr. Wolf is currently a director and chairman of the audit committee for Exponential Interactive Inc., a privately held digital advertising company. Mr. Wolf has been a director or member of the audit committee for other public companies including Quantum Corporation (from July 2007 through September 2011), Avanex Corporation (from April 2008 through April 2009), Bigband Networks (from October 2009 through March 2011), Komag, Inc. (from August 2004 through July 2007), Vitria Technology, Inc. (from February 2003 through September 2006) and Registry Magic. Mr. Wolf holds a B.A. from the University of Colorado and an M.B.A. from the University of Denver.

Board Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE THREE DIRECTOR NOMINEES.

Directors Not Standing for Election

Set forth below is information for the members of the board whose terms of directorship do not expire at the Annual Meeting and who are not standing for election at this year’s Annual Meeting, as of April 22, 2013:

|

| | | | | | |

Name | | Age | | Director Since | | Class/Term Expires |

Thomas R. Baruch(1)(2)(3) | | 74 | | 2002 | | Class I/2014 |

Alexander A. Karsner | | 46 | | 2009 | | Class I/2014 |

Bernard J. Kelley(1)(2) | | 71 | | 2004 | | Class II/ 2015 |

John J. Nicols | | 49 | | 2012 | | Class II/2015 |

| |

(1) | Member of the Audit Committee |

| |

(2) | Member of the Compensation Committee |

| |

(3) | Member of the Nominating and Corporate Governance Committee |

The following director biographical information is furnished with regard to our directors (other than our director nominees) as of April 22, 2013.

Thomas R. Baruch has served as a director of Codexis since 2002. Since November 2010, Mr. Baruch has served as managing general partner of Formation 8, a venture capital fund that he co-founded. Mr. Baruch is also the founder and partner emeritus of CMEA Capital, a venture capital firm that was established in 1989 as an affiliated fund of New Enterprise Associates. Mr. Baruch served as managing partner of CMEA Capital from 1989 to October 2010. Mr. Baruch brings to our board of directors knowledge of the biotechnology and clean technology industries as well as public company governance experience. Mr. Baruch currently serves as a director for various clean technology companies, including as a member of the board of directors of FORO Energy, a company developing a new hybrid thermal mechanical drilling technology for geothermal energy wells; as chairman of the board of directors of CNano Technology Limited, a nanomaterial company that manufactures and develops carbon nanotubes for advanced energy and other applications; as a member of the board of directors of Wildcat Discovery Technologies, Inc., a company focused on the discovery of advanced materials for clean technology applications; and as chairman of the board of directors of Intermolecular, Inc., a company offering high productivity combinatorial synthesis technologies for application in the semiconductor and clean energy sectors, where he also serves on its compensation and nominating and corporate governance committees. In addition, Mr. Baruch is currently on the board of directors of two privately-held alternative energy companies, Calysta Energy, LLC and Halotechnics, Inc. Mr. Baruch previously served on the board of directors of Entropic Communications, Inc. from 2002 to 2012. Before starting CMEA, Mr. Baruch was a founder and Chief Executive Officer of Microwave Technology, Inc., a supplier of gallium arsenide integrated circuits. Prior to his employment with Microwave Technology, Inc., Mr. Baruch managed a dedicated venture fund at Exxon Corp, and was president of the Exxon Materials Division. Earlier in his career, Mr. Baruch worked as a patent attorney and remains a registered patent attorney. He is also both a member of the Executive Committee of the Council of Competitiveness and member of the Steering Committee of the ESIS Initiative (Energy, Security, Innovation, and Sustainability) of the Council of Competitiveness. Mr. Baruch is a member of the board of trustees of Rensselaer Polytechnic Institute, the National Advisory Council on Innovation and Entrepreneurship and the Sierra Club Climate Recovery Cabinet. Mr. Baruch holds a B.S. in engineering from Rensselaer Polytechnic Institute and a J.D. from Capital University.

Alexander A. Karsner has served as a director of Codexis since December 2009. Mr. Karsner brings to our board of directors experience in and knowledge of the energy industry and related public policy. He is currently Executive Chairman of Manifest Energy, Inc., a clean energy infrastructure development and finance company. Mr. Karsner previously served as Assistant Secretary for Energy Efficiency and Renewable Energy at the U.S. Department of Energy from March 2006 to August 2008. From April 2002 to March 2006, Mr. Karsner was Managing Director of Enercorp LLC, a private company involved in international project development, management and financing of renewable energy infrastructure. Mr. Karsner has also worked with Tondu Energy Systems of Texas, Wartsila Power Development of Finland and other multi-national energy firms and developers. Mr. Karsner is a director of Applied Materials, Inc., Conservation International, Argonne National Laboratory, the Gas Technology Institute, and the National Marine Sanctuaries Foundation and is on the advisory board of Hudson Clean Energy and the Automotive X Prize. He is a Distinguished Fellow at the Council on Competitiveness, Visiting Fellow at the Hoover Institution and a leader of the Energy Future Coalition, National Petroleum Council and Council on Foreign Relations. Mr. Karsner holds a B.A. with honors from Rice University and an M.A. from Hong Kong University.

Bernard J. Kelley has served as a director of Codexis since April 2004. Mr. Kelley brings to our board of directors experience in pharmaceutical manufacturing, as well as senior management and financial operations experience. From 1993 to 2002, Mr. Kelley was the President of the Merck Manufacturing Division, a division of Merck & Co., Inc., a global pharmaceutical company, and he served as a member of the Merck Management Committee from 1995 to 2002. Mr. Kelley previously served on the board of directors of Aegis Analytical Corporation, an enterprise software company, from 2004 to 2006, and on the board of directors and compensation and audit committees of MAP Pharmaceuticals, Inc., a biotechnology company focused on developing inhalation-based therapies, from May 2007 to March 2013. Mr. Kelley holds a B.S. in engineering from the U.S. Naval Academy.

John J. Nicols has served as our President and Chief Executive Officer and as a director of Codexis since June 2012. Prior to that time, Mr. Nicols served in various capacities at Albemarle Corporation, a public company focused on the development, manufacture and marketing of highly engineered specialty chemicals, since he joined that company in 1990. Mr. Nicols most recently served as its Senior Vice President, Strategic Development and Catalysts, from March 2012 to June 2012. Mr. Nicols previously served as its Vice President, Catalysts from January 2007 to February 2012, its Vice President, Fine Chemistry from June 2002 to December 2006, its Division Vice President, Global Flame Retardants business from February 1999 through June 2002 and its Asia Pacific Business Director for the Bromine Chemicals business, based in Tokyo, Japan, from 1995 to 1998. Prior to his time with Albemarle Corporation, Mr. Nicols worked for three years in manufacturing and research and development for Hercules, Inc. Mr. Nicols received a B.S. in Chemical Engineering from the Polytechnic Institute of New York University and an M.B.A. from the Sloan School of Management at the Massachusetts Institute of Technology.

Executive Officers

The executive officers of Codexis are set forth below:

|

| | | | |

Name | | Age | | Position |

John J. Nicols | | 49 | | President and Chief Executive Officer |

David D. O'Toole | | 54 | | Senior Vice President and Chief Financial Officer |

Douglas T. Sheehy | | 46 | | Senior Vice President, General Counsel and Secretary |

David L. Anton | | 60 | | Senior Vice President, BioIndustrials |

Peter Seufer-Wasserthal | | 51 | | Senior Vice President. Pharmaceuticals |

Matt Tobin | | 51 | | Senior Vice President, Research & Development |

Executive Officer Biographical Information

The following biographical information is furnished with regard to our executive officers (except for Mr. Nicols, whose biographical information appears above under “-Directors Not Standing for Election”) as of April 22, 2013:

David O'Toole has served as our Senior Vice President and Chief Financial Officer since September 2012. From May 2010 to August 2012, Mr. O'Toole was Vice President and Chief Financial Officer at Response Genetics, Inc., a public company focused on the research and development of clinical diagnostic tests for cancer. Mr. O'Toole also served as Executive Vice President and Chief Financial Officer of Abraxis Bioscience, Inc., a public biotechnology company, from May 2008 to August 2010. From 1992 to 2008, Mr. O'Toole worked at Deloitte & Touche LLP where he served in a number of capacities, including as a partner for 12 years where he provided international business, operational and tax advice to medium and large multinational companies, including many in the life science and biotechnology sector. He also worked at Arthur Anderson & Co., from 1984 to 1992, as an international tax manager. Mr. O'Toole received his B.S., Accounting from the University of Arizona and is a certified public accountant.

Douglas T. Sheehy has served as Senior Vice President, General Counsel and Secretary of Codexis since November 2009. He joined Codexis in April 2007 as Vice President, General Counsel and Secretary. Prior to Codexis, Mr. Sheehy spent five years at CV Therapeutics, Inc., a publicly held biopharmaceutical company that developed and commercialized small molecule drugs for the treatment of cardiovascular disease, in various positions, most recently as Executive Director, Legal — Corporate Law. Prior to that, Mr. Sheehy served as an attorney with the law firms of Gunderson Dettmer LLP and Brobeck Phleger & Harrison LLP. Mr. Sheehy holds a B.A. in history from Dartmouth College and a J.D. from American University.

David L. Anton has served as Senior Vice President, BioIndustrials of Codexis since September 2012. Dr. Anton served as our Chief Technology Officer and Senior Vice President, Process Development and Manufacturing from February 2011 to September 2012 and Senior Vice President, Research and Development from May 2009 to January 2011. He joined Codexis in March 2008 as Vice President, Research and Development, for Codexis Bioindustrials. Dr. Anton has over 30 years of experience directing development of new technology solutions and production processes. He joined DuPont in 1983, and held a variety of senior research management positions across bioprocessing and biocatalysis. Dr. Anton holds a B.S. in biochemistry from the University of California, Berkeley, and a Ph.D. in biochemistry from the University of Minnesota.

Peter Seufer-Wasserthal, Ph.D. has served as Senior Vice President, Pharmaceuticals of Codexis since 2009. Dr. Seufer-Wasserthal joined Codexis in 2006 as Vice President, Enzymes & Intermediates. Dr. Seufer-Wasserthal has more than 20 years of experience in enzyme technology and business development. Prior to Codexis, he worked with Morphochem in Munich, Germany and also served as Director of Business Development Europe of Evotec OAI. Prior to that, Dr. Seufer-Wasserthal was European Sales Manager with Altus Biologics, and its sole employee in Europe. Dr. Seufer-Wasserthal started his industrial career with Chemie Linz AG (now part of DSM Fine Chemicals), as a process chemist, before moving into a position as New Business Development Manager. He holds a Ph.D. in organic chemistry from the Technical University of Graz.

Matt Tobin has served as Senior Vice President, Research & Development of Codexis since September 2012. He served as Vice President, Bioindustrial Project Management from November 2007 to September 2012. Dr. Tobin joined Codexis as a Project Manager in May 2003 at the time Codexis was spun out from its former parent, Maxygen, Inc. Dr. Tobin was originally hired by Maxygen, Inc. in March 1997 as a staff scientist. Prior to joining Maxygen, Inc., Dr. Tobin worked at Eli Lilly and Company and the Dana-Farber Cancer Institute. He is also the co-author on a variety of research publications and a co-inventor on numerous patents. Dr. Tobin holds a bachelor's degree in biology from McGill University and a D.Phil., University of Oxford Faculty of Physical Sciences at the Oxford Centre of Molecular Sciences.

CORPORATE GOVERNANCE MATTERS

Composition of the Board of Directors

Our amended and restated certificate of incorporation provides that the authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change of control at our company. Of the members of our board of directors, Messrs. Baruch, Dorgan Karsner, Kelley and Wolf are independent directors as defined under the listing standards of The Nasdaq Stock Market LLC (“NASDAQ”).

Board Leadership Structure

The role of Chairman of our board of directors is separate from the Chief Executive Officer position in order to ensure independent leadership of the board of directors. Our board of directors has determined that its structure is appropriate to fulfill its duties effectively and efficiently, so that our Chief Executive Officer can focus on leading our company, while the Chairman can focus on leading the board of directors in overseeing management.

Board Meetings

Our board held thirteen meetings during fiscal year 2012. During fiscal year 2012, all of our directors attended at least 75% of the combined total of (i) all board meetings held during the period for which each such director was a member of the board and (ii) all meetings of committees of the board of which the director was a member. Each board member is free to suggest the inclusion of items on the agenda for each board meeting. The board regularly meets in executive session without management or other employees present. The board encourages its members to attend its annual meetings of stockholders. None of the members of our board of directors attended our 2012 annual meeting of stockholders.

Board Committees

Our board of directors has the following standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of the audit committee, the compensation committee and the nominating and corporate governance committee are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee selects the independent registered public accounting firm; evaluates the independent registered public accounting firm’s qualifications, independence and performance; determines the engagement of the independent registered public accounting firm; reviews and approves the scope of the annual audit and the audit fees; discusses with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly consolidated financial statements; approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on our engagement team as required by law; reviews our consolidated financial statements and our management’s discussion and

analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC; reviews our critical accounting policies and estimates; and annually reviews the audit committee charter and the

committee’s performance. Additionally, our audit committee reviews the relevant facts and circumstances of any related party transactions and reviews the conflicts of interest and corporate opportunity provisions of our Code of Business Conduct and Ethics. The current members of our audit committee are Thomas R. Baruch, Byron L. Dorgan, Bernard J. Kelley and Dennis P. Wolf. Mr. Wolf serves as the chairman of the committee. All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our board of directors has determined that Mr. Wolf is an audit committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under applicable NASDAQ rules. Each of the members of our audit committee qualifies as an independent director under the applicable rules and regulations of the SEC and NASDAQ listing standards relating to audit committee independence. Our audit committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act and operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. The audit committee charter can be found in the corporate governance section of our website at www.codexis.com. The audit committee met six times during fiscal year 2012.

Compensation Committee

Our compensation committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The compensation committee reviews and approves corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, and sets the compensation of these officers based on such evaluations. The compensation committee also reviews and approves the issuance of stock options and other awards under our stock plans. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance of the compensation committee with its charter. The current members of our compensation committee are Thomas R. Baruch, Byron L. Dorgan and Bernard J. Kelley. Mr. Dorgan serves as the chairman of the committee. Each of the members of our compensation committee is an independent or outside director under NASDAQ listing standards and the applicable rules and regulations under the Internal Revenue Code of 1986, as amended, relating to compensation committee independence. The compensation committee operates under a written charter, which can be found in the corporate governance section of our website at www.codexis.com. The Compensation Committee met twelve times during fiscal year 2012.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for making recommendations to our board of directors regarding candidates for directorships and the size and composition of our board of directors. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies and reporting and making recommendations to our board of directors concerning governance matters. The current members of our nominating and corporate governance committee are Thomas R. Baruch, Byron L. Dorgan and Dennis P. Wolf. Mr. Baruch serves as the chairman of the committee. Each of the members of our nominating and corporate governance committee is an independent director under NASDAQ listing standards relating to nominating and corporate governance committee independence. The nominating and corporate governance committee operates under a written charter, which can be found in the corporate governance section of our website at www.codexis.com. The nominating and corporate governance committee met one time during fiscal year 2012.

There are no family relationships among any of our directors or executive officers.

Risk Oversight

Our board of directors generally oversees corporate risk in its review and deliberations relating to our activities, including financial and strategic risk relevant to our operations. In addition, our board of directors regularly reviews information regarding our credit, liquidity and operations, as well as the risks associated with each. The audit committee oversees management of financial risks. The compensation committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements and employee retention. The nominating and corporate governance committee manages risks associated with the independence of our board of directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks. Our board of directors believes that administration of its risk oversight function has not affected the board of directors’ leadership structure.

Risk Assessment and Compensation Practices

Our management assesses and discusses with our compensation committee our compensation policies and practices for our employees as they relate to our risk management and, based upon this assessment, we believe that any risks arising from such policies and practices are not reasonably likely to have a material adverse effect on us in the future.

Our employees’ base salaries are fixed in amount and thus we do not believe that they encourage excessive risk-taking. While performance-based cash bonuses and, in respect of our sales team, sales commissions, focus on achievement of short-term or annual goals, which may encourage the taking of short-term or annual risks at the expense of long-term results, we believe that our compensation policies help mitigate this risk and our performance-based cash bonuses and, in respect of our sales team, sales commissions, are limited, representing a small portion of the total compensation opportunities available to most employees. We also believe that our performance-based cash bonuses and sales commissions appropriately balance risk and the desire to focus our employees on specific short-term goals important to our success, and do not encourage unnecessary or excessive risk-taking.

A portion of the compensation provided to our employees is in the form of long-term equity-based incentives that we believe are important to help further align our employees’ interests with those of our stockholders. We do not believe that these equity-based incentives encourage unnecessary or excessive risk taking because their ultimate value is tied to our stock price.

Director Nominations and Board Diversity

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election, and the board of directors, in approving (and, in the case of vacancies, appointing) such candidates, takes into account many factors, including: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company and a general understanding of marketing, finance and other elements relevant to the success of a publicly-traded company in today’s business environment; experience in Codexis’ industry and relevant social policy concerns; experience as a board member of another publicly held company; academic expertise in an area of Codexis’ operations; practical and mature business judgment, including the ability to make independent analytical inquiries; and diversity of business or career experience relevant to the success of Codexis, such as public policy and government relations. The board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

The nominating and corporate governance committee may decide to retain an executive search firm to identify director candidates, and if so, will identify the search firm and approve the search firm’s fees and other retention terms and will specify for the search firm the criteria to use in identifying potential candidates, consistent with the director qualification criteria described above. The nominating and corporate governance committee will also consider director candidates recommended by stockholders. For a stockholder to make any nomination for election to the board at an annual meeting, the stockholder must provide notice to Codexis, which notice must be delivered to, or mailed and received at, Codexis’ principal executive offices not less than 90 days and not more than 120 days prior to the one-year anniversary of the preceding year’s annual meeting; provided, that if the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, the stockholder’s notice must be delivered, or mailed and received, not later than 90 days prior to the date of the annual meeting or, if later, the 10th day following the date on which public disclosure of the date of such annual meeting is made. Further updates and supplements to such notice may be required at the times and in the forms required under our bylaws. As set forth in our bylaws, submissions must include the name and address of the proposed nominee and the nominating person, information regarding the proposed nominee that is required to be disclosed in a proxy statement or other filings in a contested election pursuant to Section 14(a) under the Exchange Act, information regarding the proposed nominee’s and the nominating person’s indirect and direct interests in shares of our common stock, information regarding the relationships between the proposed nominee and the nominating person (and such nominating person’s affiliates and those with whom the nominating person is acting in concert), and a completed and signed questionnaire, representation and agreement of the proposed nominee. Our bylaws also specify further requirements as to the form and content of a stockholder’s notice. We recommend that any stockholder wishing to make a nomination for director review a copy of our bylaws, as amended and restated to date, which is available, without charge, upon request to our Secretary, at 200 Penobscot Drive, Redwood City, California 94063. Candidates recommended by the stockholders are evaluated in the same manner as candidates identified by a member of the nominating and corporate governance committee.

Each of Byron L. Dorgan and Dennis P. Wolf were originally recommended to the board of directors for appointment as a director by a non-management director. Pedro I. Mizutani was designated as a director by Raízen, as the permitted assignee of

Equilon Enterprises LLC dba Shell Oil Products US ("Shell"), pursuant to a voting agreement among Codexis and the former holders of our preferred stock (which was converted into common stock at the time of our initial public offering (the "IPO") in April 2010). Under the voting agreement, Raízen had the right to designate one director of the Board, subject to the Board's reasonable approval. This designation right terminated on August 31, 2012 as a result of the termination of our biofuels collaboration with Shell.

Compensation Committee Interlocks and Insider Participation

During 2012, Thomas R. Baruch, Byron L. Dorgan and Bernard J. Kelley served as members of our compensation committee. None of the members of our compensation committee has at any time during the prior three years been an officer or employee of Codexis. None of our executive officers currently serves or in the prior three years has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Communication with the Board

Interested persons, including stockholders, may communicate with our board of directors by sending a letter to our Secretary at our principal executive offices at 200 Penobscot Drive, Redwood City, California 94063. Our Secretary will submit all correspondence to the chairman of the board directors and to any specific director to whom the correspondence is directed.

Code of Business Conduct and Ethics

Our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of business conduct and ethics can be found in the corporate governance section of our website at www.codexis.com. In addition, our code of business conduct and ethics is available in print to any stockholder who requests a copy. Please direct all requests to our Secretary at our principal executive offices at Codexis, Inc., 200 Penobscot Drive, Redwood City, California 94063. We intend to disclose future amendments to certain provisions of our code of business conduct and ethics, or waivers of such provisions, applicable to our directors and officers, on our website identified above.

Director Compensation

Our non-employee director compensation policy provides that each non-employee director receives an annual cash retainer of $50,000 per year, other than the chairman of our board of directors, who receives an annual cash retainer of $100,000 per year. Non-employee directors also receive an additional annual cash retainer of $16,000 per year for being a member of our compensation committee, other than the chairperson of our compensation committee, who receives an additional cash retainer of $25,000 per year. Non-employee directors also receive an additional annual cash retainer of $5,000 per year for being a member of our nominating and corporate governance committee, other than the chairperson of our nominating and corporate governance committee, who receives an additional annual cash retainer of $10,000 per year. Non-employee directors also receive an additional annual cash retainer of $16,000 per year for being a member of our audit committee, other than the chairperson of our audit committee, who receives an additional annual cash retainer of $25,000 per year. These cash retainers are paid quarterly in arrears. During fiscal year 2012, each of Messrs. Baruch, Dorgan, Karsner, Kelley and Wolf received cash compensation pursuant to our non-employee director compensation policy. Mr. Mizutani has waived all cash and equity compensation from Codexis with respect to his service on our board of directors.

In addition to the annual cash retainers, our non-employee director compensation policy previously provided that, upon election to our board of directors, each non-employee director shall receive an initial option grant of an option to purchase 100,000 shares of our common stock with a per share exercise price equal to the per share closing trading price of our common stock on the date of grant. Such initial option grants vest and become exercisable as to 50% of the total number of shares subject to the option on the first anniversary of the date the director commences service on our board of directors, with the remainder of the option vesting and becoming exercisable at a rate of 25% of the total number of shares subject to the option each year thereafter. In addition, the policy previously provided that, on the date of each annual meeting of stockholders, each non-employee director who served at least six months on our board of directors shall also receive an annual grant of an option to purchase 20,000 shares of our common stock with a per share exercise price equal to the per share closing trading price of our common stock on the date of grant. Such annual option grant shall be vested and become exercisable as to the total number of shares subject to the option on the one year anniversary of the date of grant. All vesting of the options is contingent upon continued service to Codexis on the applicable vesting date.

The following table sets forth information regarding compensation earned by our non-employee directors who served during the fiscal year ended December 31, 2012:

Director Compensation Table |

| | | | | | | | |

Name | | Fees Earned or Paid in Cash | | Option Awards(1) | | All Other Compensation ($) | | Total |

Thomas R. Baruch | | $142,000 | | $40,314 | | $— | | $182,314 |

Byron L. Dorgan | | 96,000 | | 40,314 | | — | | 136,314 |

Alexander A. Karsner | | 50,000 | | 40,314 | | 120,000 (2) | | 210,314 |

Bernard J. Kelley | | 82,000 | | 40,314 | | — | | 122,314 |

Pedro I. Mizutani(3) | | — | | — | | — | | — |

Dennis P. Wolf | | 80,000 | | 40,314 | | — | | 120,314 |

| |

(1) | Amount reflects the grant date fair value of options granted in the year ended December 31, 2012 calculated in accordance with ASC Topic 718. The valuation assumptions used in determining such amounts are described in Note 10 to our financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012. As of December 31, 2012, Mr. Baruch had outstanding option awards to purchase an aggregate of 20,000 shares, Mr. Dorgan had outstanding option awards to purchase an aggregate of 50,000 shares, Mr. Karsner had outstanding option awards to purchase an aggregate of 123,332 shares, 56,666 of which were awarded in connection with our non-employee director compensation policy and 66,666 of which were issued pursuant to his December 2009 consulting agreement with the company, Mr. Kelley had outstanding option awards to purchase an aggregate of 128,330 shares and Mr. Wolf had outstanding option awards to purchase an aggregate of 106,664 shares. |

| |

(2) | Reflects payments made to Mr. Karsner pursuant to his December 2009 consulting agreement with Codexis. |

| |

(3) | Mr. Mizutani has elected not to receive any compensation for his service on our board of directors. |

ITEM 2

RATIFICATION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected Ernst & Young LLP, or Ernst & Young, as our independent registered public accounting firm for the year ending December 31, 2013, and has further directed that management submit the selection of our independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. A representative of Ernst & Young is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young as our independent registered public accounting firm is not required by our bylaws or otherwise. However, the board is submitting the selection of Ernst & Young to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether or not to retain Ernst & Young. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the audit committee determines that such a change would be in our and our stockholders best interests.

Principal Accounting Fees and Services

Ernst & Young provided audit, audit-related and tax services to us during the fiscal years ended December 31, 2012 and 2011 as follows:

|

| | | | |

Type of Fees | | Fiscal 2012 | | Fiscal 2011 |

Audit Fees | | $1,497,420 | | $1,933,183 |

Audit-Related Fees | | — | | — |

Tax Fees | | — | | — |

All Other Fees | | 1,600 | | 15,456 |

Total | | $1,499,020 | | $1,948,639 |

Audit Fees

This category includes fees associated with our annual audit, the reviews of our quarterly reports on Form 10-Q, and statutory audits required internationally. This category also includes fees associated with advice on audit and accounting matters that arose during, or as a result of, the audit or the review of our interim financial statements, statutory audits, government grant audits and the assistance with the review of our Form S-8 registration statements and consents.

Audit-Related Fees

There were no fees for services rendered by Ernst & Young that fall into the classification of audit-related fees for the fiscal years ended December 31, 2012 or 2011.

Tax Fees

There were no fees for services rendered by Ernst & Young that fall into the classification of tax fees for the fiscal years ended December 31, 2012 or 2011.

All Other Fees

This category includes fees associated with obtaining a value added tax refund in India in 2011 and the subscription services that Ernst & Young provided us to their GAAP database in 2011 and 2012.

Pre-Approval Policies and Procedures

Before an independent registered public accounting firm is engaged by Codexis or its subsidiaries to render audit or non-audit services, our audit committee must review the terms of the proposed engagement and pre-approve the engagement. Our audit committee may establish policies that allow the audit committee to delegate authority to a member of the audit committee to provide such pre-approvals for audit or non-audit services, provided that such person will be required to report all such pre-approvals to the full audit committee at its next scheduled meeting. In addition, if such policies are established for non-audit services, the audit committee must be informed of each non-audit service provided by the independent registered public accounting firm. Audit committee pre-approval of non-audit services (other than review and attest services) are not be required if such services fall within available exceptions established by the SEC. All fees paid to Ernst & Young for audit and non-audit services provided during fiscal years 2012 and 2011 were pre-approved by the audit committee in accordance with the policy described above.

Board Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2013.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

The following overview highlights and summarizes information regarding executive compensation and does not purport to contain all of the information that is necessary to gain an understanding of our executive compensation policies and decisions. Please carefully read the Compensation Discussion and Analysis section and the compensation tables and related disclosures that follow for a more complete understanding of our executive compensation program.

Significant 2012 Business Highlights.

| |

• | In June 2012, the company appointed John J. Nicols as our new President and Chief Executive Officer. Our board of directors engaged in extensive arms-length negotiations with Mr. Nicols and his own independent legal counsel in recruiting him to accept the position of our new President and Chief Executive Officer. As a result of these negotiations, Mr. Nicols' compensation package included equity grants that represented over 84% of his total compensation package. Our board of directors believes that the equity component of Mr. Nicols' employment package heavily incentivizes Mr. Nicols to perform his duties as President and Chief Executive Officer to drive improved financial performance and stockholder value and further align his interests with those of our stockholders. Additionally, Mr. Nicols' employment agreement requires Mr. Nicols to abide by stock ownership guidelines, such that by June 13, 2017, Mr. Nicols is required to own shares of our common stock equal to the lesser of (i) that number of shares having a fair market equal to five times Mr. Nicols' annual base salary or (ii) 1,333,333 shares. Our board of directors believes that this minimum stock ownership requirement further aligns Mr. Nicols' interests to those of our stockholders. |

| |